how does affirm make money

Here's what you should know:

- What is Affirm, and how does Affirm work?

- How does Affirm make money?

- Merchant Commissions

- Interest Fees

- Affirm Partnerships

- What is the Affirm business and revenue model?

- Affirm's profit and revenue

- Affirm's funding and valuation

How does Affirm make money? Well, here is a full, in-depth, breakdown of their two (2) revenue streams and the different products and services they offer, as well as the Affirm business model, their year-over-year revenue, Affirm partnerships, and how Affirm works.

What is Affirm, and how does Affirm work?

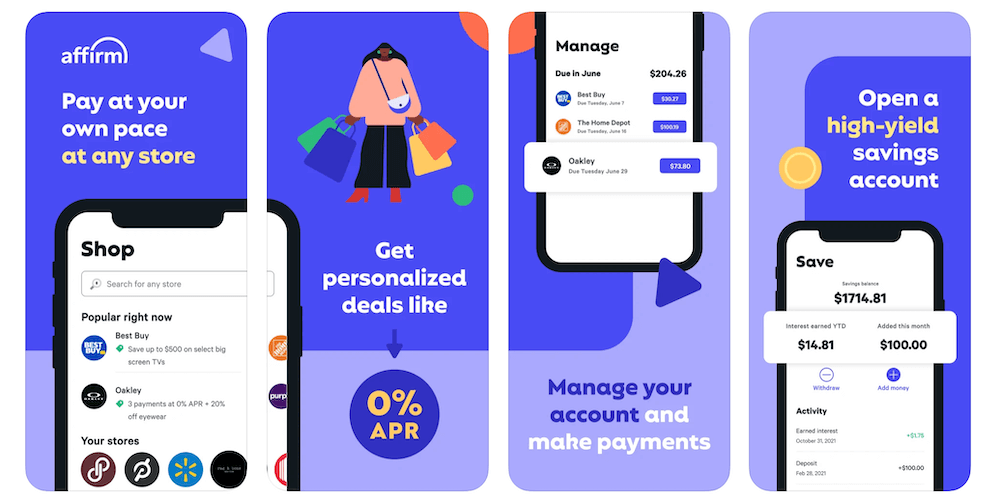

Affirm is a financial service that allows consumers to make purchases with retailers without having to pay anything at the time of purchase called "buy now, pay later" (BNPL).

Founded in 2012 by Max Levchin, Nathan Gettings, Jeffrey Kaditz, and Alex Rampell, Affirm went on to report $510 million USD of revenue in 2019 with more than 6.5 million shoppers and over 6,000 merchants partnering with them to date.

How it works is: Once a customer downloads the Affirm app and creates an account, they can then shop from partnering Affirm retailers and checkout using their Affirm account. From there, customers can choose between 3-36 month repayment term limits with interest rates between 10% – 30%.

Some of Affirm's competitors include Klarna, Afterpay, Sezzle, Quadpay, Splitit, and other "buy now, pay later" services.

How does Affirm make money?

Affirm has more than 6.5 million shoppers who purchased a combined $5.8 billion worth in sales over the past nine (9) months for over 6,000 partnering merchants.

So, how does Affirm make money off of all those customers, merchants, and transactions?

Below is a breakdown of Affirm's revenue models and how they make money off of each transaction. Including all their revenue streams and partnerships.

Here are the 2 ways of how Affirm makes money (in 2021):

Affirm generates revenue for its company in two (2) ways.

#1. Merchant Commissions

In the last nine (9) months, Affirm facilitated more than $5.8 billion in sales for over 6,000 partnering merchants, of which they receive a commission on each transaction.

The way it works is: Once a customer with an Affirm account purchases something from a partnering Affirm retailer, Affirm will then receive a commission on that purchase.

Affirm Commission Percentage:

- 2% – 3% of the subtotal

Note: Although Affirm doesn't make mention on their website about how much commission they make off their partnering merchants, some report it to be around 2 to 3 percent of the subtotal.

#2. Interest Fees

Unlike competitors like Afterpay who offer interest free loans, Affirm makes money by charging interest rates between 10 to 30 percent APR.

The interest rate is based on a soft credit pull from the customers' credit report. Once approved, Affirm will finance purchases between $50 – $1,750 and shoppers will have an option of 3, 6, 12, 18, 24, or 26-month term limits for bigger ticket items.

Affirm Interest Rate:

- 10 to 30 percent of loan amount

Note: Affirm does not charge late fees, but "partial payments or late payments may hurt your credit score or your chances of getting another loan with us," as Affirm's website makes clear.

[ Related Article: How Does Afterpay Make Money? ]

Affirm Partnerships

Affirm has a few major partnerships including Walmart and Shopify.

Walmart and Affirm Partnership

In February 2019, Walmart announced its partnership with Affirm. This deal lands Affirm in all of Walmarts 3,570 in-store supercenters nationwide.

Shopify and Affirm Partnership

In July 2020, Affirm announced that Shopify would be going into partnership with them to be the exclusive "Buy now, Pay later" payment option for all 1,132,470+ Shopify stores in the U.S.

What is the Affirm business and revenue model?

Affirm uses a few revenue models that they combine within their company to make a profit, they are:

- Commission based business model

- Interest revenue model

- B2B2C (partnerships) business model

Affirm's profit and revenue

Affirm reported $510 million USD of revenue in 2019.

Note: Because Affirm isa publicly traded company, under the Securities Exchange Act of 1934, they must file continuous financial filings with the U.S. Securities and Exchange Commission (SEC). You can find all of Affirm's publicly released financial reports, including annual reports, through Affirm's investor section on their website.

Affirm's funding and valuation

According to Affirm's crunchbase profile, Affirm has raised $2.9 billion USD over 11 rounds with a valuation of $10.6 billion.

how does affirm make money

Source: https://entrepreneur-360.com/how-does-affirm-make-money-13133

Posted by: steelhavive.blogspot.com

0 Response to "how does affirm make money"

Post a Comment